B2B e-commerce used to lag consumer commerce by a decade. That gap has largely closed. Procurement leaders now expect the same immediacy they experience when ordering personal products, but the transaction they are executing is often a six-figure operational decision.

U.S. B2B e-commerce sales exceeded $2 trillion in 2023 and continue to grow at double-digit rates, according to Digital Commerce 360’s latest market report.

What changed is not only digital adoption. It is buyer behavior. Complex purchasing groups, remote decision cycles, and AI-mediated research have quietly altered how companies sell to companies.

The next phase of B2B commerce is not about putting catalogs online. It is about rebuilding how organizations make purchasing decisions.

Below are the trends actually reshaping enterprise buying in 2026.

1. AI-Assisted Buying Is Replacing Traditional Funnels

Procurement teams are no longer starting with vendor websites. They start with AI research tools.

Forrester’s State of Business Buying research shows the typical B2B purchase now involves about 13 stakeholders across departments and external influencers. AI systems have become the first filter that those stakeholders use to narrow options.

This matters operationally. The vendor that appears first in a search engine used to control awareness. Now, the vendor whose data is structured, accessible, and explainable to AI systems influences consideration.

Marketing teams are discovering a contradiction. Brand awareness still matters, but machine readability now determines shortlisting.

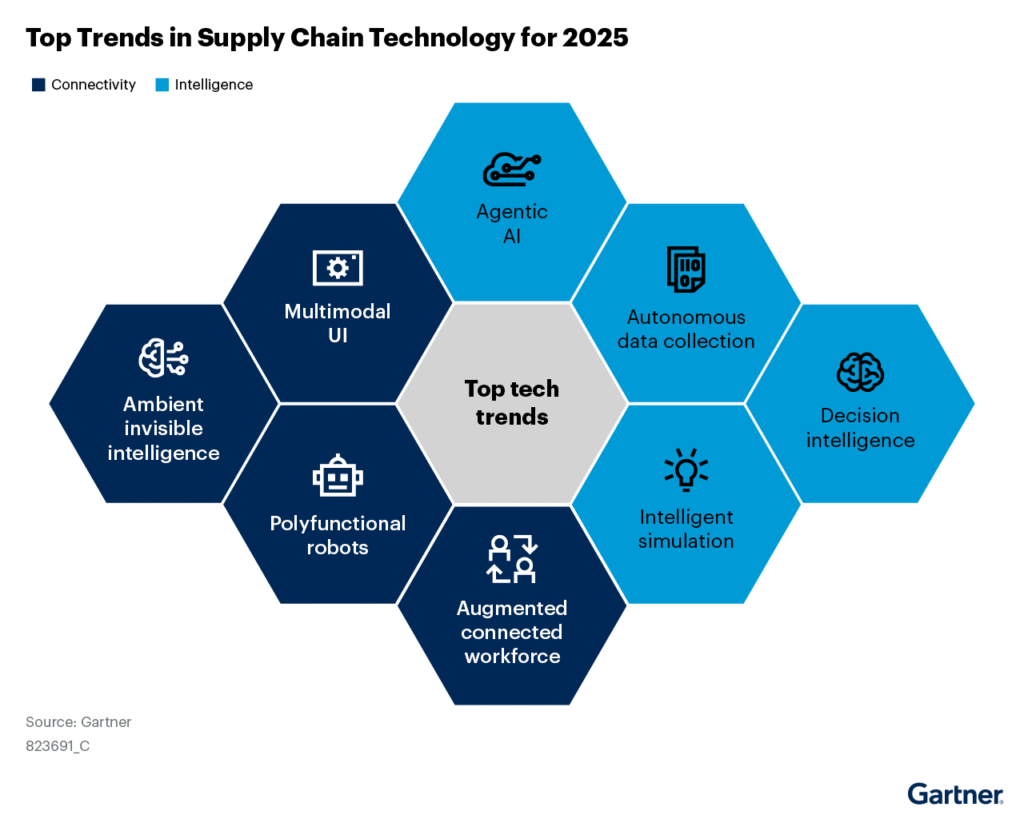

2. The Rise of Autonomous Procurement

Many repeat purchases are already being automated. Inventory replenishment, maintenance supplies, and components increasingly run on rules-based or AI-optimized ordering systems.

Gartner’s 2025 supply chain technology forecast notes that autonomous sourcing and predictive ordering are expanding as organizations try to reduce human workload in procurement operations.

The trade-off is real. Automation improves efficiency but reduces vendor differentiation. If a machine places the order, pricing transparency and fulfillment reliability outweigh brand positioning.

3. Product Data Is Becoming the New Marketing Channel

B2B buyers rarely trust sales claims. They trust specifications.

Structured product data, certifications, integration documentation, and compliance records are now influencing purchase decisions earlier than marketing messaging. Many purchasing decisions occur before a vendor interaction.

Companies that treat product information as a technical asset rather than a marketing asset are outperforming competitors in digital channels. It is not storytelling. It is documentation quality.

4. Marketplaces Are Reshaping Distribution

Industrial distribution is consolidating onto large platforms. Marketplaces now act as procurement hubs rather than comparison sites.

“We’re seeing large enterprises increasingly adopt Amazon Business as part of their procurement workflows,” said Shelley Salomon, Vice President, Amazon Business Worldwide.

Manufacturers are discovering a paradox. Marketplaces reduce customer acquisition costs but weaken direct customer relationships.

The strategic question for leadership is no longer whether to participate, but how much channel control to surrender.

5. Cybersecurity Is Becoming a Sales Barrier

B2B e-commerce is now part of enterprise infrastructure. That means security is part of the buying decision.

According to IBM’s 2024 Cost of a Data Breach Report, the average breach in industrial sectors exceeded $5 million in impact costs. Procurement teams increasingly require vendors to demonstrate security posture, not just product capability.

CISOs now influence vendor selection. Sometimes it’s more than procurement.

A vendor can lose a deal before the product demo simply by failing a security questionnaire.

6. Personalization Is Moving Into Pricing

Dynamic pricing has existed for years in consumer commerce. In B2B, it was avoided due to negotiated contracts. That is changing.

AI-driven pricing engines now adjust quotes based on order history, customer size, demand patterns, and supply constraints. McKinsey research shows data-driven pricing and advanced pricing analytics can improve margins by 2%–7% without materially harming demand when implemented correctly.

The risk is trust. Buyers accept negotiated pricing. They resist opaque pricing.

7. Self-Service Purchasing Is Now the Default

B2B buyers do not want to talk to sales unless necessary. Not because salespeople lack value, but because procurement cycles are time-compressed.

Enterprise buyers increasingly expect self-service purchasing capabilities. Salesforce’s 2024 customer research found 73% of business buyers want vendors to provide digital self-service options before direct sales engagement.

Sales teams are not disappearing, but they are entering the process later, typically once technical validation or customization is required.

Sales is moving later in the decision cycle, closer to validation than discovery.

8. Composable Commerce Architecture Is Replacing Monolithic Platforms

Traditional commerce platforms struggle to integrate with modern enterprise software stacks. Companies now favor modular architectures where catalog, payment, pricing, and analytics systems operate independently through APIs.

The reason is practical. AI tools, ERP systems, and supply chain platforms must exchange data continuously. Monolithic platforms slow adaptation.

The downside. Operational complexity increases. Organizations gain flexibility but inherit integration responsibility.

9. First-Party Data Is Becoming a Competitive Asset

Privacy regulations and declining tracking capabilities have changed B2B marketing analytics. Third-party intent signals are less reliable.

Companies now rely on behavioral data inside their own portals: search activity, configuration attempts, and abandoned orders. These signals often predict purchase readiness better than lead scoring models.

This shifts the advantage to organizations with strong digital infrastructure, not necessarily larger marketing budgets.

10. The Sales Role Is Transforming Into Advisory Commerce

Sales are not disappearing. It specializes. Routine purchasing is digital. High-risk purchasing still requires human expertise. Buyers increasingly engage sales only when complexity rises, such as in regulatory compliance, integration, or customization.

“Customers don’t want to talk to a salesperson unless they’re ready to make a decision,” said Brent Adamson, Distinguished Vice President, Advisory, Gartner. “When they do engage, they expect the interaction to add value and help them navigate complexity.”

Salespeople are becoming technical advisors. The organizations that adapt faster are aligning sales with solutions engineering rather than lead qualification.

What This Means for Leadership

The biggest mistake executives can make is treating B2B e-commerce as a channel initiative. It is an operating model change.

AI research tools influence awareness. Automated procurement influences conversion. Security influences eligibility. Product data influences trust. Platforms influence distribution. Architecture influences adaptability.

The common thread is subtle. Decisions are moving away from human persuasion toward system interoperability. B2B commerce is no longer just a sales function. It is infrastructure.

Companies that optimize marketing without modernizing data, security, and operational workflows will struggle, even with strong products. Meanwhile, technically mature organizations with modest brands will quietly win deals because their systems integrate cleanly into buyers’ environments.

The future of B2B selling is less about convincing people and more about working with the systems that now help them decide.

FAQs

1. How is AI changing B2B e-commerce purchasing behavior?

AI tools now assist buyers during research, vendor comparison, and specification analysis. Many procurement teams use AI to shortlist suppliers before engaging sales, which shifts influence from marketing messaging to data quality, documentation, and integration readiness.

2. Why are marketplaces becoming important in enterprise procurement?

Large organizations use marketplaces to simplify vendor onboarding, pricing transparency, and purchasing compliance. They reduce administrative workload and speed purchasing, though companies often trade direct customer relationships for easier acquisition.

3. Does self-service purchasing eliminate the need for B2B sales teams?

No. Routine transactions are increasingly digital, but complex deals still require human expertise. Sales teams now engage later in the cycle to handle technical validation, integration planning, customization, and risk mitigation.

4. What role does cybersecurity play in B2B e-commerce vendor selection?

Security has become a procurement requirement. Buyers now evaluate vendors’ security practices, certifications, and data protection controls alongside product capabilities because a supplier can introduce operational and regulatory risk.

5. What capabilities should companies prioritize to compete in B2B commerce in 2026?

Organizations should focus on structured product data, integration APIs, self-service purchasing experiences, and reliable fulfillment operations. Success increasingly depends on operational compatibility with buyers’ systems rather than traditional sales outreach.

Discover the future of AI, one insight at a time – stay informed, stay ahead with AI Tech Insights.

To share your insights, please write to us at info@intentamplify.com